Easy Math to Millions

In my last post, I wrote about the different stages of my retirement plan. While it explains the overall plan, I want to dive a little deeper into Stage 1.

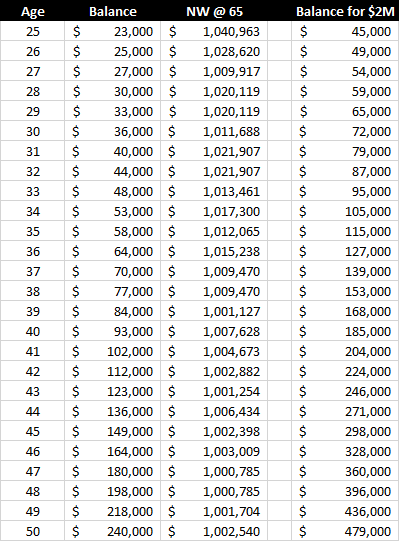

If you take out the real estate and you just want to retire at 65 with a million dollars, or two million dollars, what does that take?

Is retirement as a millionaire really possible?

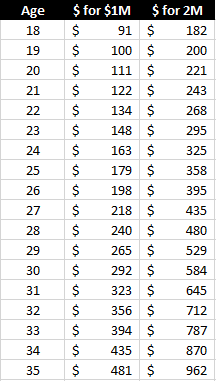

How much do you need to save if you start at 18? Or 25? Or 30?

Or what if you’re 35 with zero savings and you still want to retire a millionaire. What would that take?

Again, looking at the chart from Stage 1, if you can hit the target by that age then it wouldn’t take another dollar. Just don’t touch it, reinvest your dividends, and you have won the game.

But, what if you don’t have that dollar amount. You know you’re going to have to continue working. You don’t want to put extra money in. You want to do the minimum, enjoy your life now, but still retire a millionaire. How much do you need to invest per month?

A couple of takeaway’s from this chart.

You don’t need a million dollar income to be a millionaire. Or even a very high income for that matter.

While it does get harder as you get older, even in your thirty’s it is never too late. Start today and you can enjoy tomorrow.